What Top Coaches in Personal Finance & Wealth Coaching for Young Indians Are Missing?

circleDeep Personalisation for Unique Challenges:

⁖ Most coaches teach broad investing or financial literacy but do NOT deeply address the urgent debt struggles, impulse spending habits, and lack of personalised, stepwise wealth-building disciplines tailored for Indian young adults living with family or starting careers.

circleIntegration of Behavioural Change with Practical Digital Coaching:

⁖ Only a few address the psychological and emotional barriers behind poor money habits and combine them with a digital platform that provides ongoing accountability, tracking, and adjustment.

circleClear Pathways to Early Retirement and Second Income Streams:

⁖ Their coaching primarily focuses on wealth creation via market investments but rarely offers a comprehensive plan for early retirement, tax-efficient retirement corpus building, and diversified second income creation relevant to Indian youth.

circleCulturally Aligned, Spiritually Rooted Financial Coaching:

⁖ Almost no one incorporates India’s rich spiritual teachings (like Jainism’s ethical wealth principles) combined with financial growth—creating a unique deeper-life-purpose approach.

What Problem Does Nobody Address?

⁖ How to break cycles of short-term impulse spending combined with social pressures AND simultaneously build a disciplined, automated, diversified wealth portfolio with clear tracking in a digital environment.

⁖ This includes addressing debt relief, developing a money mindset, adopting digital finance tools and balancing lifestyle, family responsibilities, and spiritual values simultaneously.

What Method Does Nobody Use?

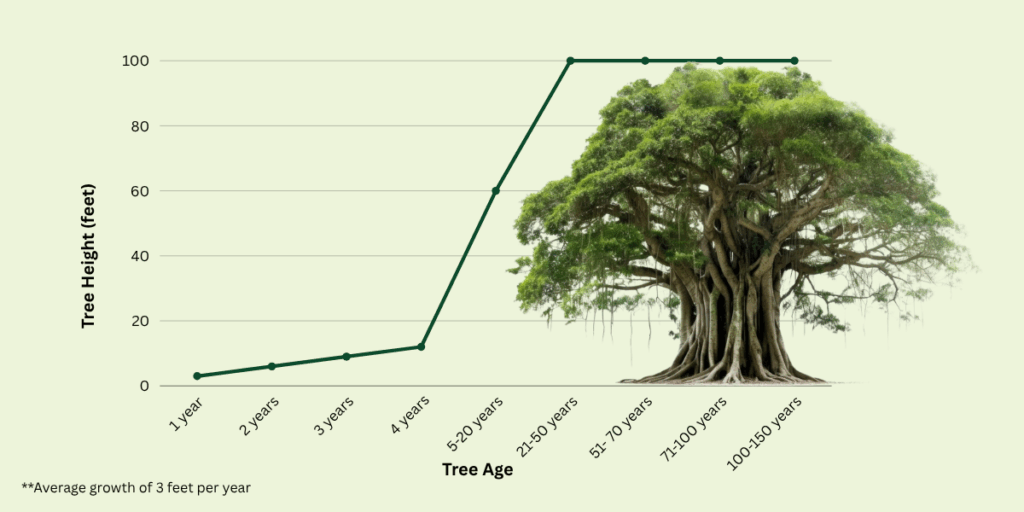

⁖ A hybrid coaching platform + course + ongoing digital accountability ecosystem empowering youth step-by-step to:

circlePersonal Financial Awareness (deep diagnostics)

circleCustomised Goal Setting & Visualisation aligned with life and spiritual values

circleHands-on Financial Planning tied to India-specific tools (tax, investments, insurance)

circleBehavioral Reinforcement (myth-busting, habit alignment, peer-community)

circleSystematic Execution with digital check-ins & progress tracking

circleReview plus Strategic Pivoting for sustained growth & early retirement

⁖ None combine education + coaching + tech-enabled progress tracking + cultural & spiritual integration into a single seamless course like the Financial Fitness Blueprint.